invest

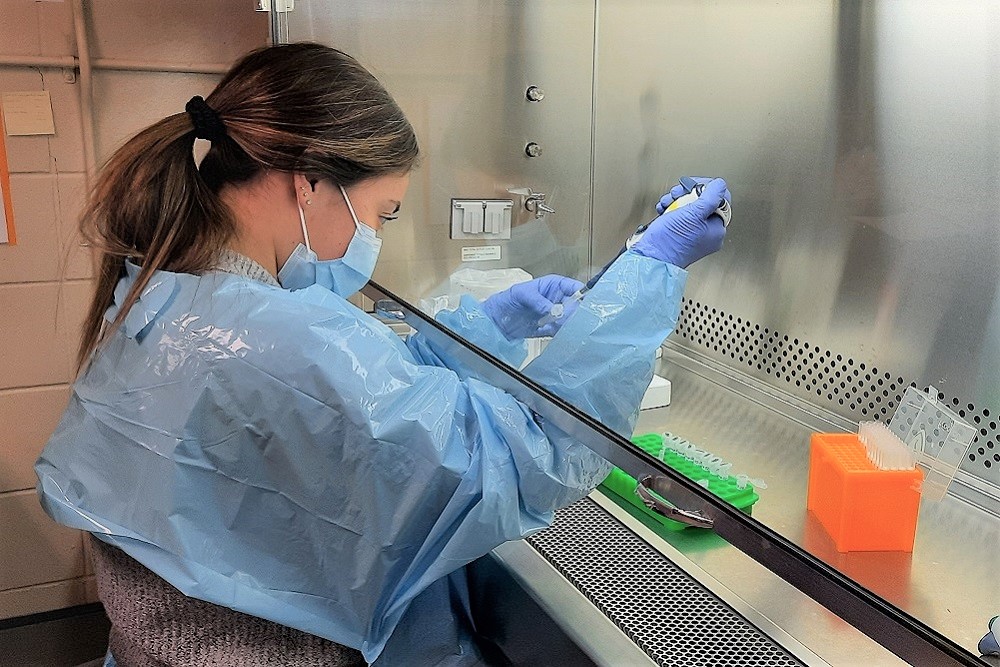

Ranked 1ST

In Canada for

Small City

startup ecosystem

Ranked #1

For foreign investment

Top 20

Places to invest

Best place to be

A woman

In canada

Start your business

Tips and Resources for starting your own business

Start

Grow your business

Strategies and insights for growing your business

Grow

Sell your business

Navigating the sale and transition of your business

Transition

kingston

The Future of

Your Business

Belongs Here

SUBSCRIBE FOR UPDATES

Subscribe to receive the latest news and updates from Kingston Economic Development.